How to fill Youtube Adsense tax information

NOTE:- TO SEE A IMAGE MORE CLEARLY JUST CLICK ON THE IMAGE AND WAIT FOR IT TO LOAD

So very recently youtube made a very important update that affects all monetized creators, here on the youtube platform so henceforth you will be paying a particular percentage of your revenue to the us tax authorities however you can get a reduced tax rate if you are resident or a citizen of some particular countries that already have tax treaties with the united states and finally does your country have a tax treaty with the u.s some countries have a tax treaty with the u.s that can potentially reduce the tax withholding rate on your revenue so if you submit your tax info and claim a treaty benefit your tax rate might be reduced for example partners in the uk or canada may be eligible for a tax rate of zero percent while partners in mexico or korea may be eligible for a tax rate of 10 percent adsense will automatically surface the opportunity to claim a treaty benefit if one exists between your country and the us

How to fill in your tax information for the new youtube adsense tax payment and how you can get a lower percentage or even zero percent

- You need to first login into your google adsense account

- Once you log in you see this notification you just click on manage tax info

- So you'll be asked to pick whether you are individual or a business because i am not a registered business here so i picked individual then you click on next

- So you'll be prompted to select a tax form so the first one is the one that fits most for me so i clicked on it

- Now, click on next, so this brings me to this page where my name is automatically impute and then if you have another name for a business entity then you might impute that on that dba

- You select your country of citizenship when you click on the drop down arrow you'll be able to see different countries so after that it will ask for your foreign team your foreign tax identification number that is you are not from the united states you are outside of the united states they want to have your tax information for the country which you are in

- Next you are going to fill in your country of residence and your address so there are two addresses your postal address and your permanent resident address so just tick the box up there that says postal address is same as permanent residence address

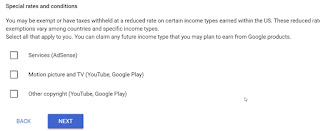

- You go on to the next one and then for the tax treaty it will ask you if you are claiming a reduced tax rates click on yes and then pick the country there are a list of countries that already have treaty with the u.s if your country is not there there's nothing you can do but if your country is there click on it

- So make sure you tick all the boxes after you clicked yes or no reach through it and click the boxes as they apply to you click on the drop down below the particular treaty that you've picked and it will bring you the article and paragraph automatically pick the withholding rate of course you want to pick zero percent or whatever percent that you see according to the country of your residence so go ahead and take as you read read make sure you read everything well then take as appropriate.

- So the next phase is where you'll be able to preview the document so there's a list of the documents as you have already filled it will automatically put it in a pdf for you click on it and you'll be able to see what the w8bn certificate looks like so if you are okay we did find you go on and ahead but if not you can actually go back and edit the things that you've already picked then you confirm that the information that you have given is correct click on next

- Then below it is the certification and all the laws and everything you might want to take your time to really reach through this so that you are sure that you are doing the right thing it will give you um the reasons for why you have picked what you have paid as long as you are sure that the reasons are right then you can go on by signing so your signature will be your full legal name and it's asking me if i'm the one with the signature so i picked yes if you are doing this on behalf of your child then you pick no

- Certify that the services provided are provided outside of the us then it will ask you if this account has already received payments before or it's a new account so i've received payment before with this so i just picked that it's an existing account

- So take the final agreement if there's any changes you want to make put it there then you click on submit so that's it now your account is set up and automatically you'll be approved and as you can see status is approved the date is there and all the claims that i've made there's zero percentage representation represents the site if you want you can always always submit

No comments: